|

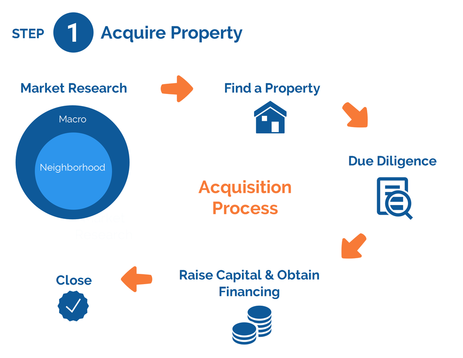

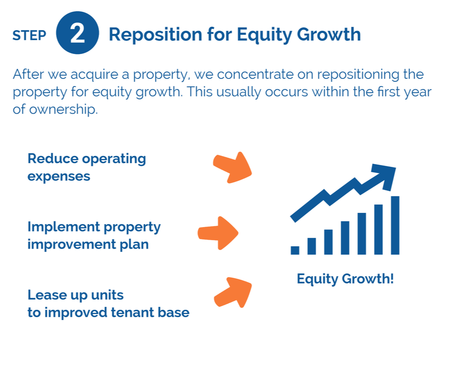

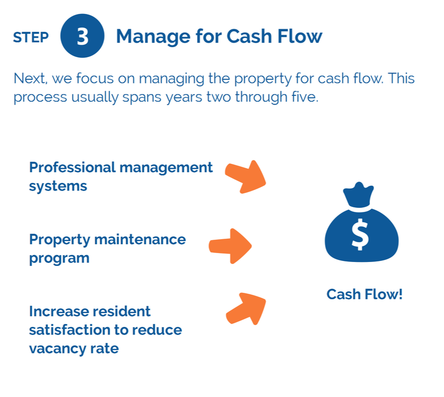

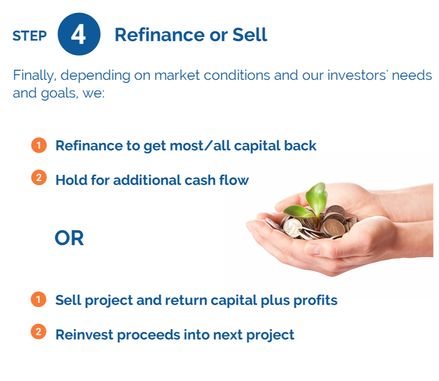

10/31/2017 Our investment model in four stepsSelecting the real estate investing strategy that works best for you is not something that happens overnight. From tax lien investing to land development to flipping houses, there are so many options to choose from, each with its own set of challenges and rewards. Whichever one you choose, it can take years to become an expert in your preferred niche. Our preferred strategy goes something like this: we buy under-performing small and medium size apartment buildings near urban core markets and add value through improved management, property renovations, and implementation of proven systems. Following is our investment model broken down into four steps: acquisition; reposition for equity growth; manage for cash flow; and refinance or sell. Acquisition. The majority of the properties we buy are not advertised publicly. We have various strategies for finding these properties, including direct mail marketing, trusted relationships with brokers who bring us deals before they hit the market, and word of mouth. Sellers often prefer to work with us because we close quickly and eliminate the hassle of listing the property on the MLS (and the commissions that go along with that option). Once we have an offer accepted, we raise the capital, obtain financing, and close. Reposition for Equity Growth. After we acquire a property, we concentrate on repositioning the property for equity growth. This usually occurs within the first year of ownership. Examples of repositioning include reducing operating expenses (e.g. negotiating more favorable rates with service providers), physically improving the property (e.g. replacing the roof, installing new kitchens, etc.), and charging higher rents to an improved tenant base. Manage for Cash Flow. Next, we focus on managing the property for cash flow. This process usually spans years two through five. We begin with professional management systems and a high quality property maintenance program. Unlike most real estate investment companies who outsource property management, we keep ours in-house. This allows us to eliminate inefficiencies due to reliance on third party vendors. We also offer tenants conveniences like online applications, rental payments, and maintenance requests, 24-hour urgent maintenance resolution, and weekend and evening move-in options. Our level of service increases tenant satisfaction and decreases vacancy rates. Refinance or Sell. Finally, depending on market conditions and investor preferences, we determine the exit strategy. We either: refinance to get most or all of the capital back, and hold for additional cash flow; or sell the asset, return the capital and profits, and reinvest the proceeds into the next project. If you'd like to learn more about our investing strategy, or if you'd just like to talk about real estate investing generally, please contact us at any time. We'd love to hear from you!

Comments are closed.

|

AuthorChristopher Kennedy and Jonathan Kennedy. Archives

January 2018

Categories |

Copyright ©2017 Mayfair Real Estate LLC, All Rights Reserved

PO Box 222, Fort Lauderdale, FL 33302

Phone: (855) 563-8273

PO Box 222, Fort Lauderdale, FL 33302

Phone: (855) 563-8273

RSS Feed

RSS Feed