1. Unfurnished units photograph much better than furnished units. Furniture can make rooms look smaller than they actually are, and some prospects may be turned off if they don’t share your taste in furniture. So, unless you’re a professional stager or interior decorator, try to take photos when your rental is completely empty. Also, remember to remove things like keys, business cards, and coffee cups from countertops before taking photos. 2. Make sure the unit is clean. No one wants to live in a dirty apartment, so if you don’t want to clean the apartment yourself, consider hiring a professional cleaning company. Check for nicks or dirty smudges in the paint, and touch up as necessary. Glossy paint is easier to clean than flat or satin paint, so consider going with a gloss finish when it comes time to repaint. 3. Maximize natural lighting. Take photos on a sunny day and open all the blinds to make the apartment feel bright and airy. Natural light is better than artificial light, but some rooms don’t have windows and others will photograph better with artificial light to supplement the natural light. As a general rule of thumb, the brighter the room, the better the photos will look. 4.Take lots of photos and think about composition. Take duplicate photos and take shots of the same room/feature from various angles. Also take photos from unusual angles, such as kneeling on the flooring looking up, or looking down from kitchen counters. Use corners, angles, and distances to achieve symmetry and balance in your photos. 5. Prioritize the kitchen and bathrooms. Take photos of every room, but make sure to capture the kitchen and bathrooms in the best light possible. Photograph features that sell, such as walk-in closets, porches, balconies, and in-unit washers and dryers. 6. Take advantage of the panoramic setting on your phone/camera. Use the panoramic setting to capture full rooms that are a little tight for space, such as bathrooms. In addition to enabling you to capture the full room in a single photo, panoramic photos can make the room feel bigger. 7. Take photos of the outside of the building. These photos should include more sky than ground. Capture a small amount of ground in front of the building, but try to keep the sky to ground ratio to roughly 2:1. 8. Enhance photos using a basic photo editing application. DO NOT SKIP THIS STEP! With today’s technology, you don’t need to know how to use Adobe Photoshop to produce professional quality images. The preset filters in an application like Google Photos will work just fine. Try to make indoor spaces feel modern by toning down colors and saturation. Try to make outdoor spaces feel bright and vibrant by bringing out deep blues and emphasizing color contrasts. 12/24/2017 How to find the best handymen on CraigslistCraigslist has a bit of a shady reputation when it comes to finding reliable handymen, but there’s no denying it can be an invaluable resource once you know how to screen out the junk. So, without further ado, here’s the tried and proven method we use to hone in on the cream of the Craigslist crop.

4.) The text of your ad is extremely important. It should convey professionalism (i.e. no typos) and provide specific instructions for prospects to follow. You want to hire someone who can read and follow instructions, so this serves as an effective pre-qualifying tool. The more information you ask for, and the more specific you are in your requests, the easier it is to eliminate time wasters and unqualified candidates. Here are a few suggestions for what to ask for:

5.) Set compensation to “Varies based on experience.” For contact information, enter your email address and check the box for CL mail relay. Do not provide a phone number—you want to force prospects to respond in writing (by email) to see if they follow the instructions you provided in your ad.

6.) If you’re going to use the responses to pre-qualify prospects, then it is important to think about what you consider acceptable responses to each of your requests. For some questions (e.g. name, email address, cell phone number) there’s no right or wrong answer—you’re just looking for complete information. For other questions, you should be prepared to disqualify the prospect based on the substance of the response (e.g. you may not want to hire someone who does not have a vehicle and tools). There are not necessarily right and wrong answers to things like labor rate and experience, but the information is useful for comparing candidates. Finally, do not hesitate to eliminate prospects for ignoring a question. 7.) For each response to your ad, run through your pre-qualification checklist and add the qualified leads to a follow up list. After a week or so, you should have a good number of promising candidates, and from there you can start interviewing and inviting vendors out to give estimates. Back in November, we picked up a 24 unit complex about 4 miles north of the center of Fort Lauderdale. The property consists of two 2-story buildings, each with 12 units. All the units are identical 2 bed/1 bath units, each just under 1,000 square feet. We liked this building for various reasons. It had been poorly managed for several years, so we knew we could add value just by improving the quality of management. Related, there was a lot of deferred maintenance. We saw this as an opportunity to improve resident satisfaction and increase the value of the building. The property also offered an opportunity to diversify into a lower income neighborhood where we could provide high quality housing to tenants receiving government assistance for their rent payments. Here are a few photos of the building before we acquired it: This is one of the more extensive renovation projects we’ve undertaken to date. In addition to floor-to-ceiling renovations throughout, we’ve been replacing 80 percent of the AC units, replacing the roof on one of the buildings, repainting the exterior, resealing and re-striping the parking lot, and increasing curb appeal with some new landscaping. At the same time, we’ve been working hard to get the tenant base in order—when we bought the building, almost half of the units were occupied by non-paying tenants. Despite the challenges, we managed to get the first renovated unit on the market last week. Not bad for a month’s work! We still have a long way to go, but overall we’re very happy with the way this one has turned out. One of the best parts of a project like this is the overwhelmingly positive response we’ve been getting from tenants as we work to improve their community. If all goes as planned, we’ll soon have nothing but happy tenants, happy investors, and another successful project under our belt. In the meantime, here are some pictures of the ongoing renovations: Well maintained properties reflect pride of ownership and demonstrate professionalism to your tenants and neighbors. Furthermore, if your tenants see you going the extra mile to keep their community in good shape, they're much more likely to reciprocate. There are any number of things you can do during a routine visit to keep your properties looking nice, so why not take a few minutes to show your tenants you care? Here’s a simple routine to get you started:

As you can see, none of these are grueling or time consuming tasks. Moreover, as you get into the habit of running through the checklist, you’ll start to see fewer things that need to be fixed or tidied each time you visit the property. It’s a really simple way to improve your value as a property manager, increase tenant satisfaction, and preserve the value of your property. So, next time you’re at your property, ask yourself, “What can I do right now to make my property look nicer?” Finding highly qualified tenants and screening out bad ones is one of the hardest parts of managing an investment property. Ideally you want someone who pays the rent on time, respects your property and the neighbors, and won’t try to get out of the lease early. Easier said than done—but not impossible. Here are a few tips for getting it right. Pre-Screening Make sure your applicants filled out the application completely and followed all of the application instructions. If they can’t do this much, they probably won’t make a reliable tenant. Rental History Require applicants to provide a three year residence history and contact information for a minimum of two previous landlords. Search property tax records for all of the addresses referenced in the tenant’s application and contact the owners to verify that the applicant did, in fact, live in the property. Applicants sometimes provide false contact information for previous landlords. Tracking down the owners through tax records is a good way to mitigate this risk. When you talk to landlords, verify that the applicant paid rent on time, did not damage the property, and did not cause any other trouble.

Cash Industry Income

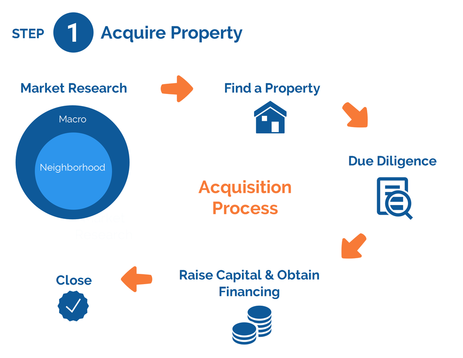

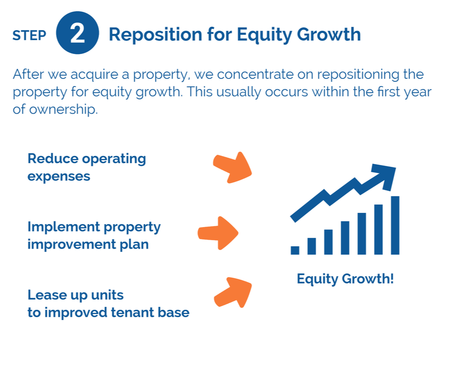

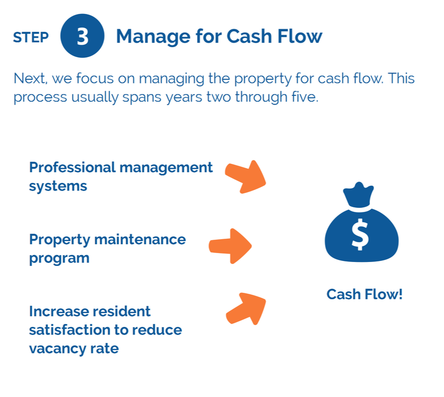

If your applicant works in a cash industry, such as bartending, ask her to submit a letter from her employer stating the employer’s name, address, phone number, and the applicant’s on-the-books and off-the-books income. Cash industry applicants often make excellent tenants, so don’t risk turning away good tenants just because their income is harder to verify. Verifiable vs. Reported Income Once you verify your applicant’s income, cross-check it against the income reported in the application. If your applicant is prepared to lie about her income on the application, who knows what else she has lied about? Social Media This should be a no-brainer, but make sure you Google your applicants and check to see what they’ve been up to on social media. www.picodash.com is a good resource for searching Instagram and Twitter. Excessive partying, drug use, and undisclosed pets are all things to look for. If your rental has a no smoking policy, check for photos of your applicant smoking cigarettes. Verify and Cross-Check Everything If it isn’t obvious by now, a general rule of thumb is to verify and cross-check everything in your applicant’s application. Don’t take their word for it. Do your own research and don’t accept anyone until you have a full and accurate picture of them. It’s hard work, but you’ll be happy you put in the effort. 10/31/2017 Our investment model in four stepsSelecting the real estate investing strategy that works best for you is not something that happens overnight. From tax lien investing to land development to flipping houses, there are so many options to choose from, each with its own set of challenges and rewards. Whichever one you choose, it can take years to become an expert in your preferred niche. Our preferred strategy goes something like this: we buy under-performing small and medium size apartment buildings near urban core markets and add value through improved management, property renovations, and implementation of proven systems. Following is our investment model broken down into four steps: acquisition; reposition for equity growth; manage for cash flow; and refinance or sell. Acquisition. The majority of the properties we buy are not advertised publicly. We have various strategies for finding these properties, including direct mail marketing, trusted relationships with brokers who bring us deals before they hit the market, and word of mouth. Sellers often prefer to work with us because we close quickly and eliminate the hassle of listing the property on the MLS (and the commissions that go along with that option). Once we have an offer accepted, we raise the capital, obtain financing, and close. Reposition for Equity Growth. After we acquire a property, we concentrate on repositioning the property for equity growth. This usually occurs within the first year of ownership. Examples of repositioning include reducing operating expenses (e.g. negotiating more favorable rates with service providers), physically improving the property (e.g. replacing the roof, installing new kitchens, etc.), and charging higher rents to an improved tenant base. Manage for Cash Flow. Next, we focus on managing the property for cash flow. This process usually spans years two through five. We begin with professional management systems and a high quality property maintenance program. Unlike most real estate investment companies who outsource property management, we keep ours in-house. This allows us to eliminate inefficiencies due to reliance on third party vendors. We also offer tenants conveniences like online applications, rental payments, and maintenance requests, 24-hour urgent maintenance resolution, and weekend and evening move-in options. Our level of service increases tenant satisfaction and decreases vacancy rates. Refinance or Sell. Finally, depending on market conditions and investor preferences, we determine the exit strategy. We either: refinance to get most or all of the capital back, and hold for additional cash flow; or sell the asset, return the capital and profits, and reinvest the proceeds into the next project. If you'd like to learn more about our investing strategy, or if you'd just like to talk about real estate investing generally, please contact us at any time. We'd love to hear from you!

In our last post, we explained the benefits of using good debt to jumpstart your investment strategy. As promised, today we’ll talk about how to take on as much good debt as possible without taking too many risks. There are three main risks associated with borrowing money: over-leveraging; risk related to loan terms; and counter- or third-party risk. Over-Leveraging. People often balk at the idea of taking on debt for fear of over-leveraging themselves—that is, taking on too much debt against a property. What is too much debt? A property is over-leveraged when there is not enough cash flow to pay for the debt. Imagine you had a $10,000 annual debt payment on a property. In a break even scenario, the net cash flow (gross income less operating expenses) on the property before debt payments is $10,000. But as an investor you want to make money, not just break even. Ideally, you should build in a cushion. In technical terms, this is what lenders refer to as debt service coverage ratio (DSCR). Most commercial lenders will require a DSCR of 1.25, which means the net operating income needs to be at least 25% more than the annual debt service. In other words, you can pay the mortgage and still have 25% extra (or $2,500 per year) for unforeseen expenses. You might ask, “OK, so you’ve got a DSCR of 1.3, but what happens when something happens to that property that requires more than the extra 30 percent you’ve set aside?” The best way to prepare for the worst case scenario is to have a prudent cash reserve on hand. A good rule of thumb is 4-5% of the asset value. Where people often get into trouble is dealing with residential lenders and conventional loans on smaller residential properties. Lenders in this arena do not care about DSCR. They care about the value of the property and the borrower’s ability to repay the loan. This makes it extremely easy to become over-leveraged. Here’s an example: Joe Shmo earns $60,000 a year and decides he wants to buy a $100,000 house. He has $10,000 saved for a down payment and no problem qualifying for a $90,000 mortgage. A few years later, Joe accepts a job in another state. Unfortunately for Joe, the market hasn’t been strong and his house has depreciated. To make matters worse, Joe has all his equity in the house and just discovered that the house will not generate enough income as a rental property to cover his annual mortgage payments. Joe would not be in this position if he had considered the DSCR before purchasing the house. But such is the nature of residential loans—they are tied to the borrower’s ability to repay, not the asset’s ability to generate income. Loan Terms. Loan terms are another source of risk in taking on debt. Balloon payments and adjustable rate mortgages (ARMs) are the two most common examples.

One of the biggest risks with commercial loans is taking on a balloon payment that comes too soon (after three years, for example). Under certain circumstances short term loans are viable, but we usually do not take on loans with a balloon payment sooner than ten years from the date of origination. Historically – even if you start at 2009 – property values tend to recover over a ten year period. Three years, however, is risky. If you took out a loan in 2008 with a three year balloon payment, in 2011 that property would be much less valuable. That creates a problem, because not only would the value of the property be insufficient to cover the loan, but you’ve also had very little time to pay down the principal balance. With a ten year balloon payment, even if property values plummet in year ten, you’ve had ten years to pay down the loan and are much less likely to find yourself underwater. Shorter term loans become less risky as the loan-to-value (LTV) ratio decreases or in situations where real value (renovations or rent increases) can be created quickly. The real risk is taking a high LTV loan for a short term, in which case a shift in market conditions can put you underwater very quickly. Risk also comes in the form of rate repricing through ARMs. This is what got a lot of people in trouble in 2008. If loan payments change every month based on some sort of index, then that creates uncertainty and risk. Many commercial loans have fixed dates for rate changes—three, five, or seven year price adjustments. However, like most risks, if you’ve planned accordingly, a rate adjustment is not going to sink you. If you’ve got a property with a 1.35 DSCR, for example, a rate adjustment may eat into your cash flow but it’s highly unlikely to be a deal killer. Counter- or Third-Party Risk. When you take on debt, you bring another partner to the equation. Lenders have the right to take back the property if you mess up or don’t follow the loan agreement. You may also be affected if the lender gets into trouble due to external economic factors beyond your control. While worth mentioning, this is a fairly small risk.

Key to a successful debt strategy is making sure you always have cash in reserve. Whenever you pull equity out of a property, you should set some aside for a rainy day fund. How much is enough? We use two rules of thumb, depending on the circumstances. One, as we mentioned earlier, is 4-5% of asset value (typically used for stabilized assets that we plan to hold for the long term). On a $1 million property, we hold at least $40,000 in reserve to cover emergency expenses. The second is 6 months’ holding costs (we might use this figure when completing a renovation project, for example). In the highly unlikely scenario that your property goes completely vacant, then you can afford to carry the building for six months while you work to restore it to full operational capacity. When it comes down to it, these two numbers – 4% of asset value and six months’ holding costs – are often comparable.

Control More Property. Leverage enables you to control more property than you could otherwise control if you used only your own cash. For example, let’s say you had $100,000 in cash. You could use that money to buy a single house worth $100,000, or you could use the same money to buy five houses of equal value with 20 percent down. Now let’s assume property values appreciate by 10 percent over the next 10 years. If you bought a single $100,000 house, then you’d gain $10,000 in equity from the appreciation. Alternatively, if you bought five houses with 20 percent down, then you’d gain $50,000 in equity from the appreciation (i.e. $10,000 per house). Which would you rather have at the end of ten years, $10,000 or $50,000? Use Inflation to Your Advantage. Leverage allows you to use inflation to your advantage. We looked at real estate as a hedge against inflation in an earlier blog post, suffice to say leverage enables you to pay back borrowed money with future dollars that are less valuable than they are today. Asset Protection. Debt makes for an excellent asset protection strategy. If you owned a $100,000 rental property free and clear and your tenant happens to slip and fall (or maybe you just have a litigious tenant), then you have $100,000 at risk should your tenant attempt to sue you and force the sale of the property. However, if you only have $20,000 of equity in the property, then the property becomes a much less enticing target.

Hedge Against Down Markets. Debt serves as a nice hedge against downturns in the market. If the market takes a plunge and your property that was worth $100,000 two years ago is only worth $60,000 today, then your equity takes a pretty big hit if you own the house outright ($40,000, to be exact). Alternatively, if you had an $80,000 mortgage on the house (i.e. $20,000) and the value of the house drops to $60,000, then you’ve only lost $20,000 in equity. As long as you’re paying your mortgage and getting cash flow from the property, it really doesn’t matter if the value of the house goes up and down.

Ultimately, you want to build equity over time and across multiple assets. You accomplish that by taking on as much good debt as possible to accelerate your investment strategy and create wealth. In our next post, we’ll explain how to accomplish that without taking too many risks. Many very successful investors have done it, and you can too.

As our first foray into the short-term vacation rental market, this project is a little different from anything we’ve worked on in the past. At least one of the apartments will have to be ADA approved, which means meeting certain parking and bathroom accessibility requirements. We’ll also be going with higher end luxury finishes in the kitchens and bathrooms. And then there’s furniture to think about…calling all interior designers!

That’s all for now folks, stay tuned for updates! |

AuthorChristopher Kennedy and Jonathan Kennedy. Archives

January 2018

Categories |

Copyright ©2017 Mayfair Real Estate LLC, All Rights Reserved

PO Box 222, Fort Lauderdale, FL 33302

Phone: (855) 563-8273

PO Box 222, Fort Lauderdale, FL 33302

Phone: (855) 563-8273

RSS Feed

RSS Feed